How Your Credit Score Affects Home Buying: Understanding Your Options

Published on 2024-04-18

Investler Realty

How Your Credit Score Affects Home Buying: Understanding Your Options

The journey to homeownership is thrilling, but it can also come with a fair share of myths and misconceptions, especially regarding the importance of having a perfect credit score. At Investler Realty, we're here to demystify the process and shed light on the reality that a range of home buying options exists for every credit tier and income level.

Your Credit Score: A Gateway, Not a Gatekeeper

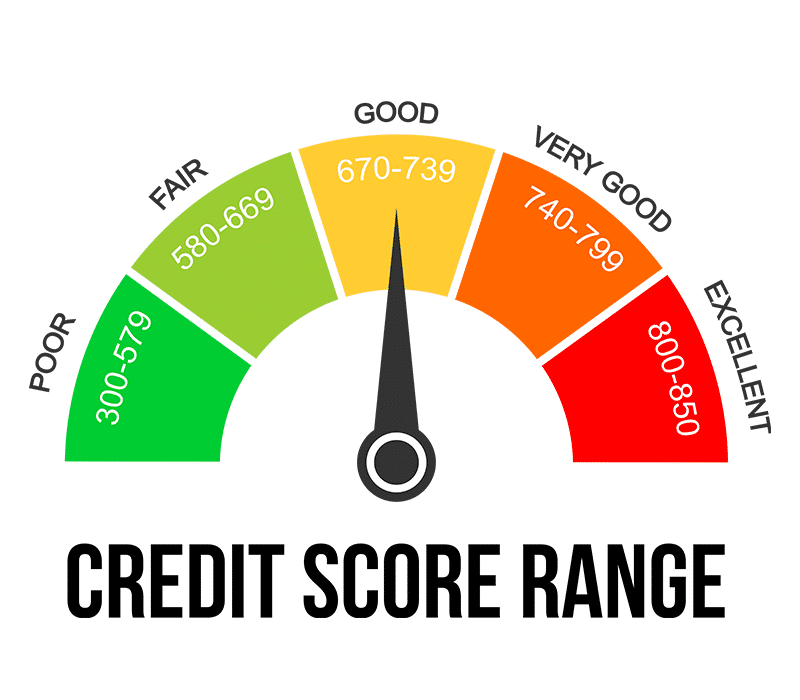

Your credit score is one of the key factors lenders consider when assessing your mortgage application. It’s a numerical summary of your credit history and gives lenders a quick way to gauge your creditworthiness. A higher credit score can typically offer you more favorable loan terms, including lower interest rates. However, a less-than-perfect credit score doesn't lock you out of the housing market.

Finding Home Buying Success at Any Credit Score

At Investler Realty, we believe that everyone deserves a chance to own their dream home. Here's how you can navigate the home buying process, regardless of your credit score:

For Higher Credit Scores:

If your credit score is high, congratulations! You'll likely have access to the most competitive mortgage rates and terms. Here’s what you can do to leverage your score:

Shop around for the best rates.

Consider a shorter-term mortgage for faster equity building.

Explore traditional loan options with lower down payments.

For Middle-Range Credit Scores:

Don’t worry if your credit score isn’t top-tier. You still have plenty of options:

Look into FHA loans, which are designed for borrowers with lower credit scores.

Investigate local and federal homebuyer programs that offer assistance.

Work with your real estate agent to understand how to present a strong offer.

For Lower Credit Scores:

A lower credit score is not an insurmountable hurdle. With the right strategy, you can still find a pathway to homeownership:

Save for a larger down payment to offset the credit risk and secure lender confidence.

Consider an adjustable-rate mortgage (ARM) to start with a lower interest rate.

Repair your credit by working with credit counseling services to improve your score over time.

Investler Realty: Your Partner in Homeownership

No matter your financial situation, Investler Realty is here to help. Our team of experienced real estate agents is adept at finding creative solutions to fit your unique circumstances. We provide personalized assistance throughout the home buying process, from credit counseling referrals to identifying the best mortgage lenders for your needs.

In Closing

Remember, your credit score is just one part of your financial story. With Investler Realty, you'll receive expert guidance tailored to your personal home buying journey. Whether you're ready to buy now or planning for the future, we’re here to turn your homeownership dreams into reality.

Call us today at (386) 341-2183 or visit www.InvestlerRealty.com to start your home buying adventure.

*Notes:*

The information provided in this article is intended for informational purposes only and should not be considered as legal or financial advice.While every effort has been made to ensure the accuracy and reliability of the content, Investler Realty assumes no responsibility for any errors or omissions. The circumstances surrounding individual real estate transactions are unique; therefore, we strongly recommend consulting with a qualified real estate attorney or other certified professionals to provide advice tailored to your specific situation. By reading this article, you agree that Investler Realty and the article’s author(s) are not liable for any decisions you make based on the content.